Deposit Schedules – For monthly depositors, you must show the combined amount of social security, Medicare and withheld federal income taxes owed for each month in Part 2 of Form 941 or Part 2 of Form 944. For semiweekly depositors, you must show the combined amount of social security, Medicare and withheld federal income taxes owed for bookkeeping each day on Schedule B (Form 941) or Form 945-A (if filing Form 944). You become liable for employment taxes when you pay the employees their wages, not when the pay period ends. Regardless of whether you own and operate a small business or a multibillion-dollar corporation, if you pay employees a wage, you have to file Form 941.

The IRS is diligent in the way it keeps track of employee wages and how much needs to be taken out of those retained earnings wages in the form of taxes. Form 941 must be filed on a quarterly basis (every 3 months) every year.

In most cases, you can also e-file your SUI and SIT forms if your account is active for state e-services. In a few states where e-filing isn’t available, we’ll provide you with a signature-ready paper form or bookkeeping a worksheet to prepare the official form provided by the state tax agency. Don’t reduce your monthly tax liability reported on line 16 or your daily tax liability reported on Schedule B (Form 941) below zero.

Only small business employers who’ve been notified by the IRS to file Form 944 may file it. To report wages and taxes for farm employees, you must file Form 943, Employer’s Annual Tax Return for Agricultural Employees (PDF). See Topic No. 760 for reporting and deposit requirements for agricultural employers. For information about e-filing, please see E-file Employment Tax Forms. If your business has employees, you are required to withhold payroll taxes from each employee’s wages, including Medicare, Social Security and federal income taxes.

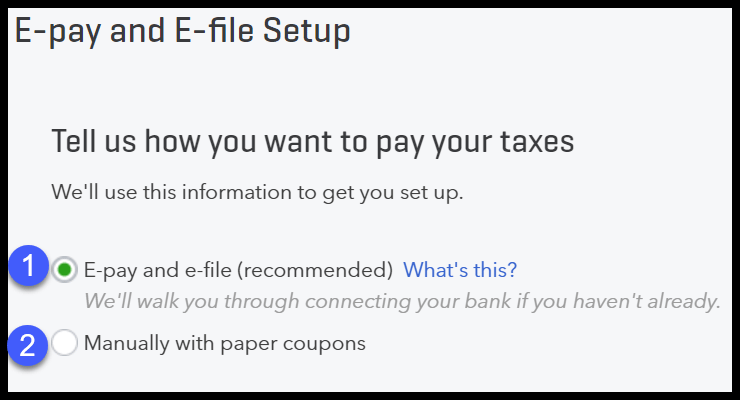

In general, quarterly tax forms can be filed electronically or manually. You can e-file Form 941 through your Intuit Online Payroll Enhanced and QuickBooks Online Payroll Enhanced account if it’s active for federal electronic services.

Support

Adjustments and Corrections – In certain cases, you must adjust amounts reported as social security and Medicare taxes to arrive at your correct tax liability. You may add or subtract this difference on the line for fractions-of-cents adjustments.

If you go out of business or stop paying wages to your employees, you must file a final return. To tell the IRS that Form 941 for a particular quarter is your final return, check the box on line 17 and enter the final date you paid wages. Also attach a statement to your return showing the name of the person keeping the payroll records and the address where those records will be kept.

However, if you have employees whose annual payroll tax withholding liabilities are less than $1,000, you may be able to file on an annual rather than quarterly basis. Employers must file a quickbooks payroll e file 941 quarterly Form 941 to report wages paid, tips your employees have received, federal income tax withheld, and both the employer’s and employee’s share of social security and Medicare taxes.

How to e-file Federal Forms 940, 941, and 944

Employers must file quarterly tax returns for their business. The Internal Revenue Service expects employers to file Form 941 to report wages paid, tips received, taxes withheld and submission of Social Security and Medicare taxes. Failure to file IRS Form 941 or to deposit taxes owed can cost the employer penalties. If you have no employees, you are not required to file Form 941.

- Adjustments and Corrections – In certain cases, you must adjust amounts reported as social security and Medicare taxes to arrive at your correct tax liability.

Can you e file 941 through QuickBooks?

You may now e-file forms 940, 941, and 944 in QuickBooks Desktop using your existing 10-digit PIN. Go to Employees, and then Payroll Center. Select Federal Form 940 from the list of forms, and then select Edit. In the Filing Method options, select E-file and then Finish.

As a business operator, you are required to file Form 941 on a quarterly basis for all of your employees. The four-page form notifies the IRS of your employees’ taxable income and liability every quarter, reporting the withholdings for federal income tax and Social Security/Medicare taxes. Seasonal employees https://bookstime.com/articles/quickbooks-payroll-services do not require Form 941 to be filed if, and only if, they don’t work one or more quarters. All businesses are expected to file this form at the end of April, July, October, and January. Rose Co. is an employer with a calendar tax year that filed its timely income tax return on April 15, 2020.

If you pay wages subject to federal income tax withholding or social security and Medicare taxes, you must file Form 941 quarterly to report the following amounts. Generally, as an employer, you’re responsible to ensure that tax returns are filed and deposits and payments are made, even if you contract with a third party to perform these acts. You remain responsible if the third party fails to perform any required action. For more information on the different types of third-party payer arrangements, see section 16 in Pub.

Set up your Federal Forms 940, 941 and 944 for e-file in QuickBooks Desktop

You are also responsible for depositing the income tax withholdings and filing quarterly payroll tax returns with the Internal Revenue Service. The IRS sets strict rules on when to deposit taxes, depending on your liability, and when to file the payroll tax return. If you are late depositing or filing your return, the IRS will impose penalties.

Form 941 is due by the last day of the month that follows the end of the quarter. This form is also known as the Employer’s Quarterly Tax Form and is used by employers to report the federal withholdings from most types of employees. It notifies the IRS of a number of important figures, like the employment taxes taken from employee pay and the amount owed to the IRS. Specifically, Form 941 requires a business owner to report the number of employees, the amounts withheld from each of the employees, all Social Security withholdings, and all Medicare withholdings. It also requires the business owner to list any advances on earned income credits that are paid out to employees, if that’s applicable.

Form 941, Employer’s Quarterly Tax Return, is used to report employment taxes. If you own and operate a business with employees, you will need to file IRS Form 941 quarterly. You, the employer, are responsible https://www.bookstime.com/ for withholding federal income tax, social security tax, and Medicare tax from each employee’s salary. This form is also used to calculate the employer’s portion of Social Security and Medicare tax.

Rose Co. elected to take the qualified small business payroll tax credit for increasing research activities on Form 6765. The third quarter of 2020 is the first quarter that begins after Rose Co. filed the income tax return making the payroll tax credit election. Therefore, the payroll tax credit applies against Rose Co.’s share of social security tax on wages paid to employees in the third quarter of 2020. Rose Co. is a semiweekly schedule depositor.

Consistent with the entries on line 16 or Schedule B (Form 941), the payroll tax credit should be taken into account in making deposits of employment tax. The payroll tax credit may not be taken as a credit against income tax withholding, Medicare tax, or the employee share of social security tax. Also, the remaining payroll tax credit may not be carried back and taken as a credit against wages paid from preceding quarters. Employers notified to file Form 944, whose businesses grow during the year and whose employment tax liability exceeds the $1,000 threshold, must still file Form 944 for the year. Employers who exceed the eligibility threshold must not file Form 941 until the IRS notifies them that their filing requirement has been changed to Form 941.