Finally the study recommends the global adoption of IFRS, Particularly for https://accountingcoaching.online/ emerging economies and Nigeria banking sector should embrace best corporate governance practices. IFRS (International Financial Reporting Standards) is a set of international accounting standards which has been established by the IFRS Foundation and International Accounting Standards Board (IASB).

Benefits Of Ifrs

The aim of the paper is to assess the IFRS adoption progress in Ethiopia and investigate factors that motivate Ethiopia to adopt IFRS, advantages and challenges ahead of IFRS adoption in Ethiopia . Both primary which is collected through open-ended interview and secondary data collected using https://accountingcoaching.online/blog/income-statement-format-components-and-purpose/ document analysis techniques from the annual reports of companies reporting under IFRS, and proclamations and regulations that deal with financial reporting issues in Ethiopia. The result of the study revealed some companies in Ethiopia have started using IFRS voluntarily since 2002/03 without making necessary preparedness but nationally; IFRS is adopted officially in December, 2014 through enactment of Proclamation.

In 2011, SEC staff introduced a possible method of incorporating IFRS into the U.S. financial reporting system that would represent an endorsement and convergence approach for aligning U.S. Ultimately Journal Entries , the expectation is that the SEC will make a determination on whether it will incorporate IFRS into the financial reporting system for U.S. issuers and, if it decides to incorporate IFRS, the method of incorporation. It will provide international investors the ability to make well- informed, useful and meaningful comparison of investment portfolio in Nigeria and other countries.

International Financial Reporting Standards (Ifrs Standards)

According to the study conducted by (Thappa, 2012) the challenges of adopting IFRS by banks are classified into technical challenges and other challenges. In 2001, the IASC was reorganized into International Accounting Standard Board (IASB) with an objective to develop global standards and related interpretations that are now collectively known as International Financial Reporting Standard (IFRS).

What are the benefits of adopting IFRS?

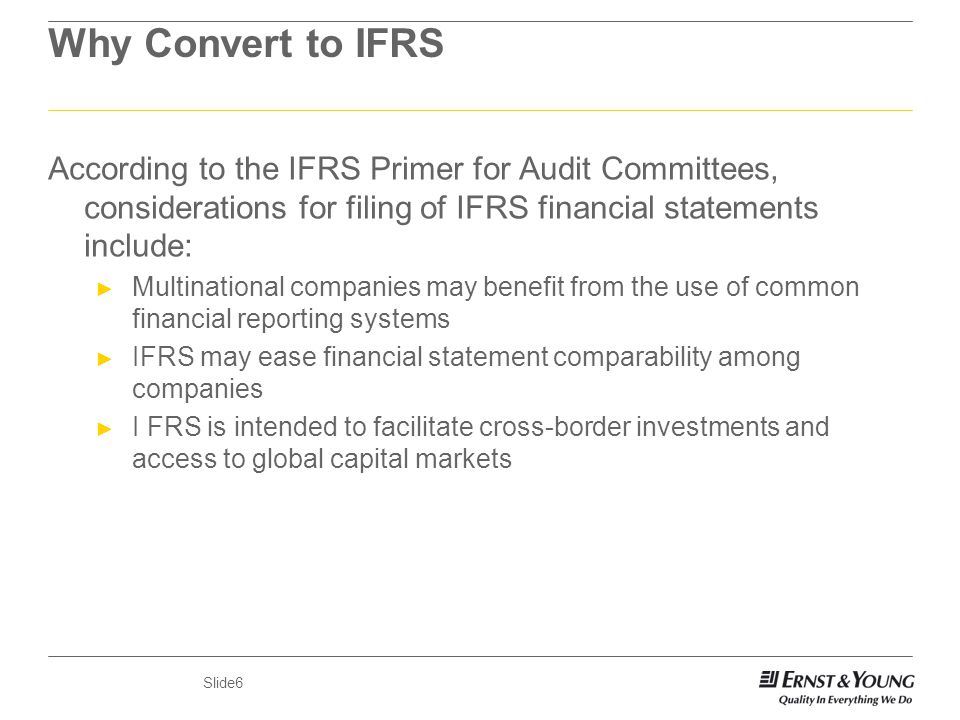

Benefits of IFRS Standards IFRS Standards bring transparency by enhancing the international comparability and quality of financial information, enabling investors and other market participants to make informed economic decisions.

Should We Stay (Gaap) Or Should We Go (Ifrs)?

Since then International Accounting Standards Board (IASB), based at London -UK is now responsible to issue International Financial Reporting Standard IASB is an independent body and consists of members from nine different countries around the globe having variety of functional backgrounds. The IASB has continued to develop standards calling the new standards IFRS (Kumar, 2014). Between 1973 and 2001, the IASC issued 41 standards or IASs before it was replaced by the International Accounting Standards Board (IASB) (Ojiedu et.al, 2013). Various studies have been conducted to assess adoption of IFRS in different countries around the world. Most of these studies conducted on the data from developed and industrialized countries.

Your Source For Ifrs Guidance

The key players are the Securities and Exchange Commission, which is responsible for the supervision and regulation of the securities industry and has oversight responsibility for the FASB; the Financial Accounting Standards Board, an independent body that establishes and interprets U.S. GAAP; and the IASB, which is working with the FASB on the convergence of U.S. The AICPA has provided thought leadership to the IASB and the FASB on financial reporting topics. You must follow the established accounting standards if your stock is publicly traded or you provide financial statements to people outside of your business, like investors.

This Framework is designed to help the Board develop IFRS Standards. The Framework is also designed to help those applying IFRS Standards address matters not covered by IFRS Standards. However, the Framework is not a Standard and the accounting requirements in an IFRS Standards take precedence over the Framework. Through the Board’s due process, it consults and engages with investors, regulators, business leaders and the global accountancy profession at every stage of the process, whilst maintaining collaborative efforts with the worldwide standard-setting community. In developing IFRS Standards and Interpretations the Board publishes and seeks public comment on Discussion Papers and Exposure Drafts.

- The Board develops and maintains a set of accounting requirements collectively referred to as International Financial Reporting Standards (IFRS Standards).

- Members are appointed by the Trustees through an open and rigorous process that includes advertising vacancies and consulting relevant organisations.

- The Trustees are publicly accountable to a Monitoring Board of public authorities.

- The Board is an independent group of experts with an appropriate mix of recent practical experience in setting accounting standards; in preparing, auditing, or using financial reports; and in accounting education.

This has brought about a shift away from local financial reporting standards to global standards. Because of the advantages it provides for countries, multinational companies and regulators, many counties adopt International Financial Reporting Standards. IAS is International Accounting Standards (IAS) which was issued between 1973 and 2001 by the International Accounting Standard Committee (IASC). On 1 April, 2001, IASC was replaced by International Accounting Standards Board (IASB).

(Olano.et.al,2014) investigated the relationship between International Financial Reporting Standards and the quality of banks financial statement information by using data from banks audited financial statements and capital market performance report and employing Eviews for analyses. The study concludes that not only IFRS adoption is associated with high accounting quality evidenced there are factors beyond the fundamentals – capital market fraud- which determine stock market valuation.

The globalization has brought a lot of changes in doing business across the world. The use of different accounting frameworks in different countries creates confusion for users of financial statements resulting into inefficiency in capital markets across the world.

Important Principles Of Modern Accounting

The IASB was formed in 2001 to replace the International Accounting Standards Committee (IASC). A full history of the IASB and the IASC going back to 1973 is available on the IASB website. Generally Accepted Accounting Principles or GAAP refers to the standard framework, principles and procedures used by the companies for financial accounting. The principles are issued by Financial Accounting Standard Board (FASB). It is a set of accounting standards that consist of standard ways and rules for recording and reporting of the financial data i.e. balance sheet, income statement, cash flow statement, etc.

GAAP is not the international accounting standard; this is a developing challenge as businesses become more globalized. The International Financial Reporting Standards(IFRS) Key benefits of IFRS is the most common set of principles outside the United States and is used in places such as the European Union, Australia, Canada, Japan, India, and Singapore.

Disadvantage: Increased Costs

Accounting standards in the European Union and some countries in Asia are governed by the International Financial Reporting Standards (IFRS), which is governed by the International Accounting Standards Board (IASB), created in 2001. In case the initial disclosure event occurs between the balance sheet date and the date on which the financial statements Key benefits of IFRS for that period are approved by the board of directors, disclosures required by Accounting Standards 4 are made. International Financial Reporting Standard 9 (IFRS 9) will soon replace International Accounting Standard 39 (IAS 39). The change will materially influence banks’ financial statements, with impairment calculations affected most.

Various literatures revealed challenges in the process of IFRS adoption. Need of amendment to regulatory requirement and tax laws, high implementation cost, more complex financial reporting requirements, shortage of IFRS specialist and tight dead line are the major challenges. Financial institutions particularly banks is expected to be most affected by changes Key benefits of IFRS in accounting standards specifically IFRS adoption or convergence (Olano.et.al, 2014). According to (IASB, 2014) as cited in (Olano.et.al, 2014) moving to IFRS has had a major impact on the reporting requirements of financial institutions. With the advent of globalization, global capital markets have witnessed rapid expansion, diversification and integration.